Request a free asset check up

What is the asset check up?

The assets check-up consists of a detailed and comprehensive assessment of your assets in their entirety. In essence, we analyze all the components that affect wealth, i.e. financial investments, pension situation, insurance products and real estate investments. Being aware of your assets not only allows you to take care of them, but is the first step in achieving your financial goals.

In the event that the client is in possession of his own portfolio or of certain financial products, Busnelli & Associati first of all ensures that the instruments are subjected to a scrupulous screening of efficiency, which includes an analysis of costs and comparison with the yield of the market and of our portfolios. Particular attention is given to the cost analysis thanks to the quantification of the “hidden fee” retained by intermediaries (management, entry, exit, performance, negotiation, administrative costs, advertising, custodian bank, etc.).

In addition to analyzing the instruments contained individually, we ensure that the portfolio is adequately diversified so that it is composed of different asset classes, geographical areas, currencies and issuers and that it is not overly exposed to any of these.

Last but not least, we assess whether your assets correspond to your stated risk profile and financial objectives.

The analysis is carried out with due confidentiality and exposed to the client during a free consultation appointment.

The advantages of the asset check-up

- Overall asset evaluation

- Identification of efficient and inefficient financial instruments

- Identification of the risks to which you are exposed

- Identification of the costs actually incurred, including hidden costs

- Identification of the investor’s risk profile and financial objectives

- Evaluate the consistency between the investor’s risk profile/financial objectives and their asset allocation

- Outline an effective strategy to achieve their financial objectives

Focus on Hidden Costs

Generally, when savers purchase financial products of asset management, i.e. mutual funds, asset management and policies, they do not attach much importance to their costs. Many even think that they are free. On the contrary, the costs are high. The main costs are: the entry fee, the management fee, the performance fee and the exit penalty.

All the fees listed above have a significant effect on the performance of the products in question. On average, the costs of a mutual fund amount to 2.2% per year of the capital invested, while those of the policies reach 3%-4%. A considerable sum if compared to an ETF (passive fund) whose cost is on average 0.2% of the invested capital.

Here is what Ivass (the Institute for Insurance Supervision) has to say about certain insurance investment products: “The reduction […] in the annual returns of the policies due to costs is, in certain cases referring to unit-linked and multi-branch policies, very high and such as to raise doubts about the profitability of the products for the clients. More specifically, 35% of multi-branches and 40% of unit-linked policies have costs in the order of 3-4%. On the other hand, 8% of multi-branch policies and 43% of unit-linked policies exceed 4%.

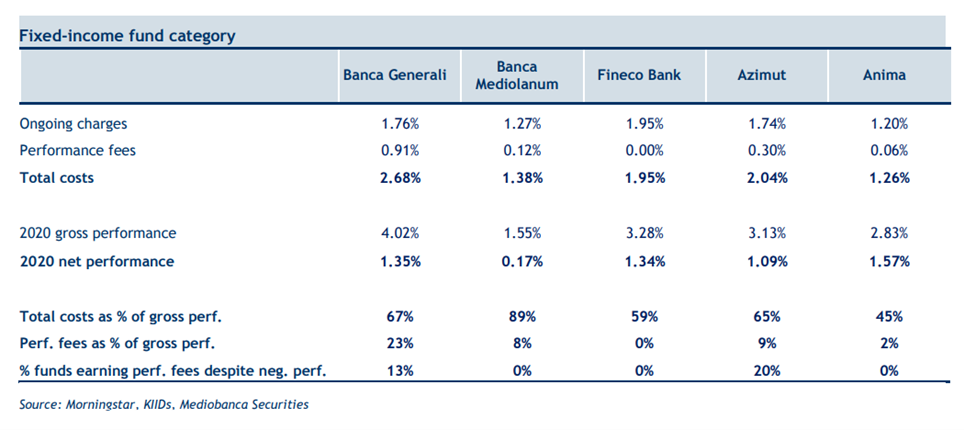

A recent study by Mediobanca shows the costs of Italian asset management.

This table shows the management and performance fees of the top 40 equity funds sold by Italy’s leading asset management banks.

This table shows the costs of bond funds and how much they affect returns. Two-thirds of the return goes away in costs!

As illustrated in the Table Comparing Costs of Policies, Mutual Funds and ETFs, if you invest a capital of 100,000€, in 30 years, the Policy generates 105,000€ in commissions charged to the investor, the Mutual Fund generates 66,000€ in commissions, while the ETF generates only 9,000€.

The 96,000€ difference between the Policy and the ETF and the 57,000€ difference between the Mutual Fund and the ETF is the lost income that is taken away from you by the bank and the financial promoter.

Policy, Mutual Fund and ETF Cost Comparison

| wdt_ID | Periodo | Polizza | Fondo Comune | ETF |

|---|---|---|---|---|

| 1 | Costo: 3,5% | Costo: 2,2% | Costo: 0,3% | |

| 2 | 1 anno | 3.500 € | 2.200 € | 300 € |

| 3 | 10 anni | 35.000 € | 22.000 € | 3.000 € |

| 4 | 20 anni | 70.000 € | 44.000 € | 6.000 € |

| 5 | 30 anni | 105.000 € | 66.000 € | 9.000 € |

| 6 | Differenza | 96.000 € | 57.000 € |